Implementation of the services

This section explains how to implement Stancer’s services for your business.

API

Stancer gives merchants the possibility of collecting payments through an API (Application Programming Interface). This API allows you to collect payments from your customers on your e-commerce website.

In order to use our payment services on your website, you will have to integrate our API by following the steps detailed below.

1. Choose an integration method

The appropriate integration method for your business activity will depend on, among other things:

- your availability: certain methods of integration require an integration period that is generally longer.

- the extent to which you wish to personalise the payment experience: some integration methods offer possibilities for customization.

- your technical capabilities (development and maintenance)

Available integration methods

This table summarises the possible integration methods and their characteristics:

| Integration mode | Integration time | Possibility of personalisation | Technical skills required |

|---|---|---|---|

| Paylink | None | Low | None |

| CMS modules | Low (< 1 day) | Low | None |

| Redirect | Low (< 1 day) | Low | Moderate |

| Iframe | Depending on your technical knowledge | High | Advanced |

| Full API | Depending on your technical knowledge | High | Advanced |

Paylinks

If you do not have a retail website or do not wish to process payments on your website, this method is particularly appropriate. This method involves creating a unique paylink for each transaction. All you then have to do is to send your customer the paylink in order to collect the payment from them.

FAQ

- Does my company name appear on customer receipts and statements?

Yes, your company name will appear on your customers' receipts and statements. However, after your contract is activated, please allow up to 48 hours for the information to sync in our payment system. If, after this period, the name does not appear correctly, please contact our customer service.

CMS modules

This integration method is suitable if you already have an e-commerce website based on one of the e-commerce CMS platforms that we support. This integration method involves installing a payment module developed by our teams in your CMS. Once installed and parameterized, this module makes it possible for your customers to pay for their purchases on your e-commerce website.

To discover how to install these modules, click on the CMS that you use for your website and follow the instructions:

Redirect: the link to a secure payment page

This integration method involves redirecting your customers to a page hosted by Stancer, in order to collect their payments. It is a secure and effective way to start your online business activity. Stancer handles the complete management and maintenance of the payment page: your customers pay for their purchases in complete security. This is a fast solution to implement, which avoids you having to manage any aspects of the transactions.

iframe

Stancer develops and maintains ready-to-use payment fields for your e-commerce website. These fields facilitate the integration of our API and we ensure the compliance of your website in terms of security. You will then use these fields to create the payment form for your e-commerce website. This form is thus fully integrated into your e-commerce website, to ensure an optimised payment experience.

Full API: the completely transparent integration mode

This integration method is suitable if you are developing or have completely developed your payment form. The payment experience is completely transparent for your customers and your technical teams. You can customize all aspects of the payment form fields to ensure complete integration with your e-commerce website.

In choosing the Full API integration method, you become responsible for sending information concerning your customers’ payment cards and for the integrity of that information. You must ensure that this information is sent to Stancer. PCI DSS certification is required in excess of a certain volume of transactions. In practice, our teams recommend this integration method for undertakings with technical teams that are able to implement and also maintain the payment forms that are developed.

2. Integrate the Stancer API

It is now time to start the integration of the Stancer API. At the end of this integration phase, you will be able to receive the first payments from your customers.

Pre-requisites

The online technical documentation will enable you to initiate your first technical messages to our API. You will first need the test keys that are available to you on your User Area.

Tools

Tools are made available to you free of charge on your User Area, on the Developers page.

Our IT libraries: the libraries for various computer languages (Python, PHP, Perl),

The Stancer API technical documentation.

Integration using the chosen method

- Paylinks: no integration is necessary.

To create your paylinks: go to your User Area, then enter the amount and the payment information. Then, send the paylink that is created to your customer (by e-mail or SMS).

- CMS: you need to install the Stancer module in your CMS.

Go to your dedicated space and select the module that is suitable for your e-commerce website. Then follow the installation and parametrization stages for the module, in order to install it on your e-commerce website.

- Redirect, iframe and Full API: Make sure you have your test keys and production keys.

FAQ

- I have not received my production keys: what is happening?

Please note that your production keys are only available after your Client File has been approved. Once your sign-up has been finalised and your account approved, your production keys will be available on the Developers page of your User Area. If the production keys are still not available 48 hours after the approval of your Client File, please contact our support team using the Help page on the User Area.

3. Test the Stancer API

Using the tools, you can start to integrate our API and send the API your first payments. Stancer will provide you with a set of test payment cards and IBANs, which will automatically generate the various possible responses from our API.

4. Collect your payments

Once all the tests have been carried out, you can replace your test keys with your production keys, so that actual payments can be sent to the Stancer production API.

Tap to Pay

With Tap to Pay via the Stancer app, you can accept all in-person, contactless payments directly on your smartphone or tablet — whether they come from bank cards, Google Pay, Apple Pay, or other digital wallets. No extra terminal or hardware is required — only the Stancer app. It’s simple, secure, and private.

1. How to activate it?

To start using Tap to Pay, follow these steps:

- Sign up and download the Stancer app from the Google Play Store (Android) or the App Store (iPhone).

- Log in to your Stancer Account.

- In the app, follow the instructions to activate Tap to Pay, or tap “Tap to Pay” in the “Need help?” → “Account” section.

2. How does it work?

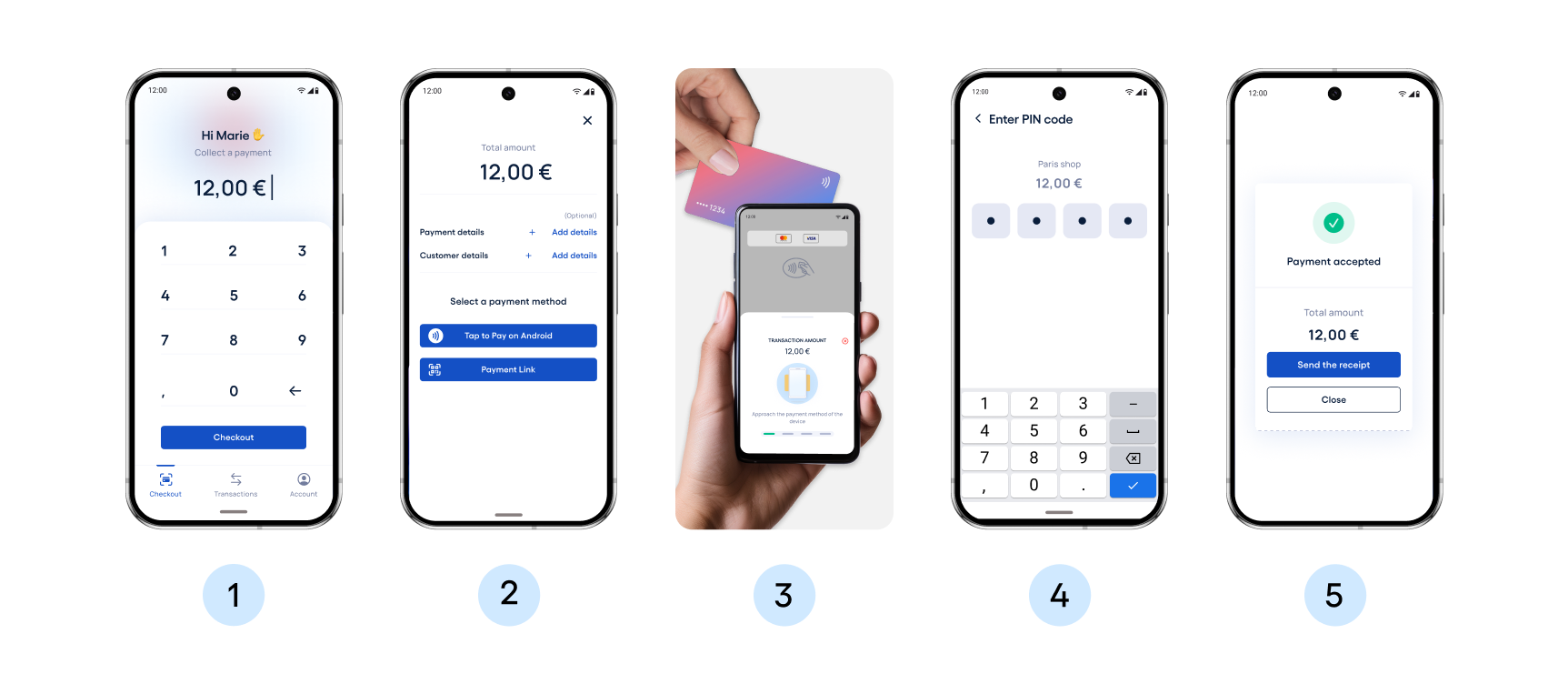

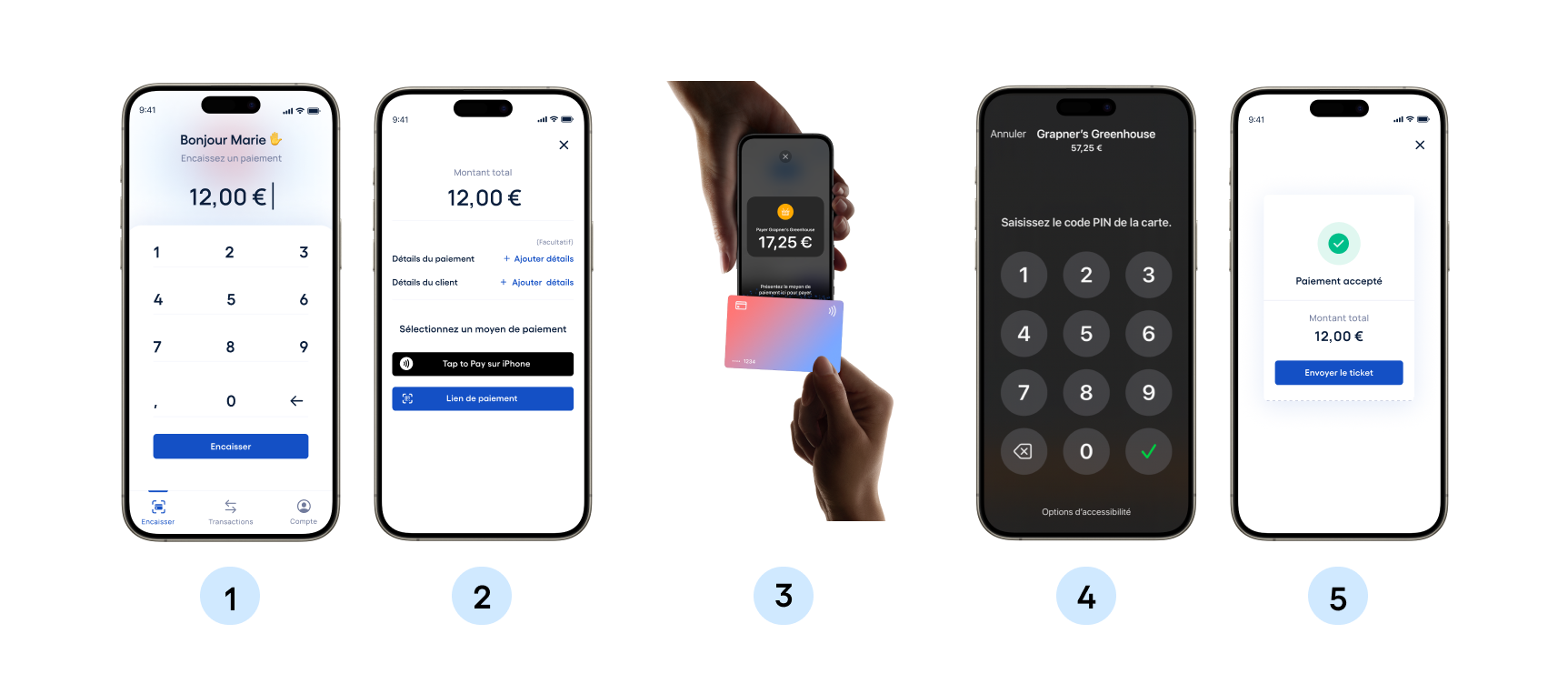

To accept a payment with Tap to Pay:

- Open the Stancer app and enter the amount to be paid.

- Select “Tap to Pay” and present your device to the customer.

- The customer holds their bank card or compatible smartphone near the back of your device to make the payment.

- Use Tap to Pay to accept payments that require a PIN to be entered to confirm the payment.

- Once the transaction is approved, the receipt appears on the screen and can be shared instantly.

On Android:

On iPhone:

3. Contactless payment and PIN code

With Tap to Pay on the Stancer app, you can accept:

- Contactless payments (cards, Apple Pay, Google Pay, digital wallets)

- Payments requiring a PIN code

🔹 Contactless: Tap to Pay does not enforce any payment limit. The limit depends on the customer’s bank (e.g. most French debit cards allow contactless up to €50).

🔹 With PIN code: when required, the device automatically displays a secure PIN entry screen (Apple on iPhone, Stancer on Android).

FAQ

- What devices are compatible with Tap to Pay?

Android

Smartphones and tablets running Android 12 or later, GMS-certified, equipped with NFC technology, and updated with the latest version of Android. Devices must have Google Play Services up to date, be non-rooted, with debugging mode and developer options disabled, and have automatic time settings enabled to ensure proper network synchronization. Entry-level models with weaker NFC antennas may experience reduced performance.

iPhone

iPhone XS or later, running the latest version of iOS.

- What payment methods are accepted with Tap to Pay?

With Tap to Pay, accept in-person, contactless payments from bank cards, Apple Pay, and smartphones equipped with other digital wallets.

- What is the settlement delay for funds?

Collected amounts are transferred to your Bank Account within 7 business days. This delay allows us to verify payments and protect against fraud. Funds are stored in your Payout Accounts during this period, then transferred to your Bank Account minus our fees.

Note: the delay may be extended in case of public holidays.

- What if a contactless card cannot be read?

- Check that the card has the contactless symbol.

- Place the card over the NFC area of your device (chip on the left side).

- If reading fails, slightly move the card to align the chip.

- If the issue persists, the card may be damaged or incompatible. Suggest using another card or a digital wallet.

- Does Tap to Pay support transactions requiring a PIN code?

Yes. After presenting their card, the customer may be prompted to enter their PIN via the secure interface (Apple on iPhone, Stancer on Android).

- How can I process a refund?

- Open the Stancer app and go to Transactions.

- Select the Tap to Pay payment.

- Tap Refund and confirm.

Note: With Tap to Pay, please note that the card used for the refund must be the same as the card previously used for the payment. Refunds can be made from any device that shares the same type of operating system.

- Does my company name appear on customer receipts and statements?

Yes, your company name will appear on your customers' receipts and statements. However, after your contract is activated, please allow up to 48 hours for the information to sync in our payment system. If, after this period, the name does not appear correctly, please contact our customer service.

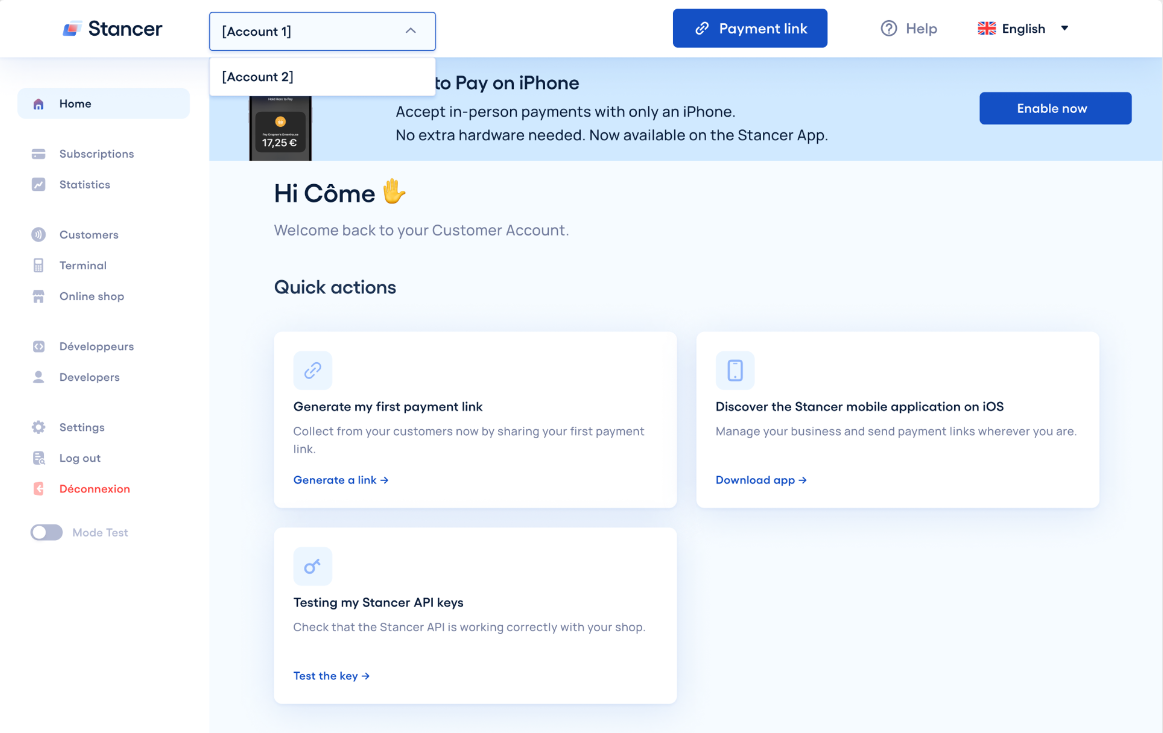

4. How to switch from one account to another

Managing Multiple Account

If you have multiple projects (online and/or physical) operating independently, it is recommended to use separate Stancer accounts. Each new account is governed by Stancer's standard policies and pricing.

If you would like to add a new account linked to your company, please submit a request by contacting our support team at support@stancer.com.

Switching Between Accounts

- On the customer portal : Go to the menu at the top of the homepage and select the account you wish to view from the dropdown list.

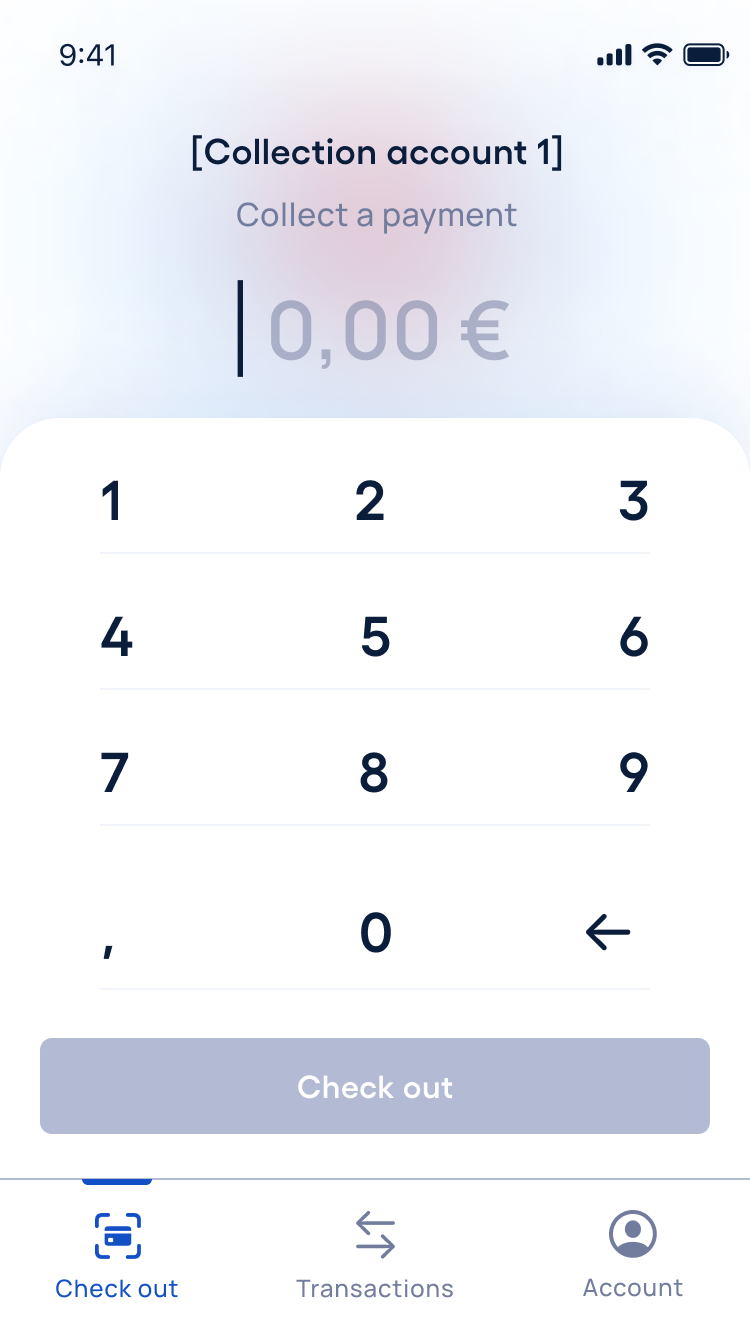

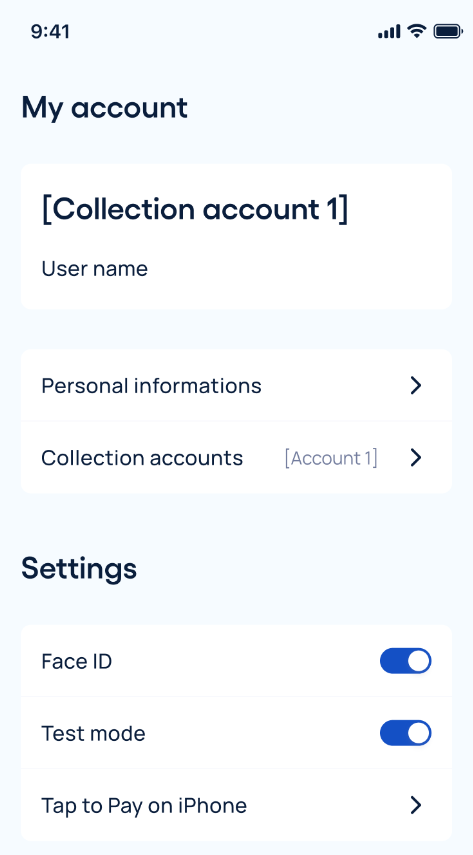

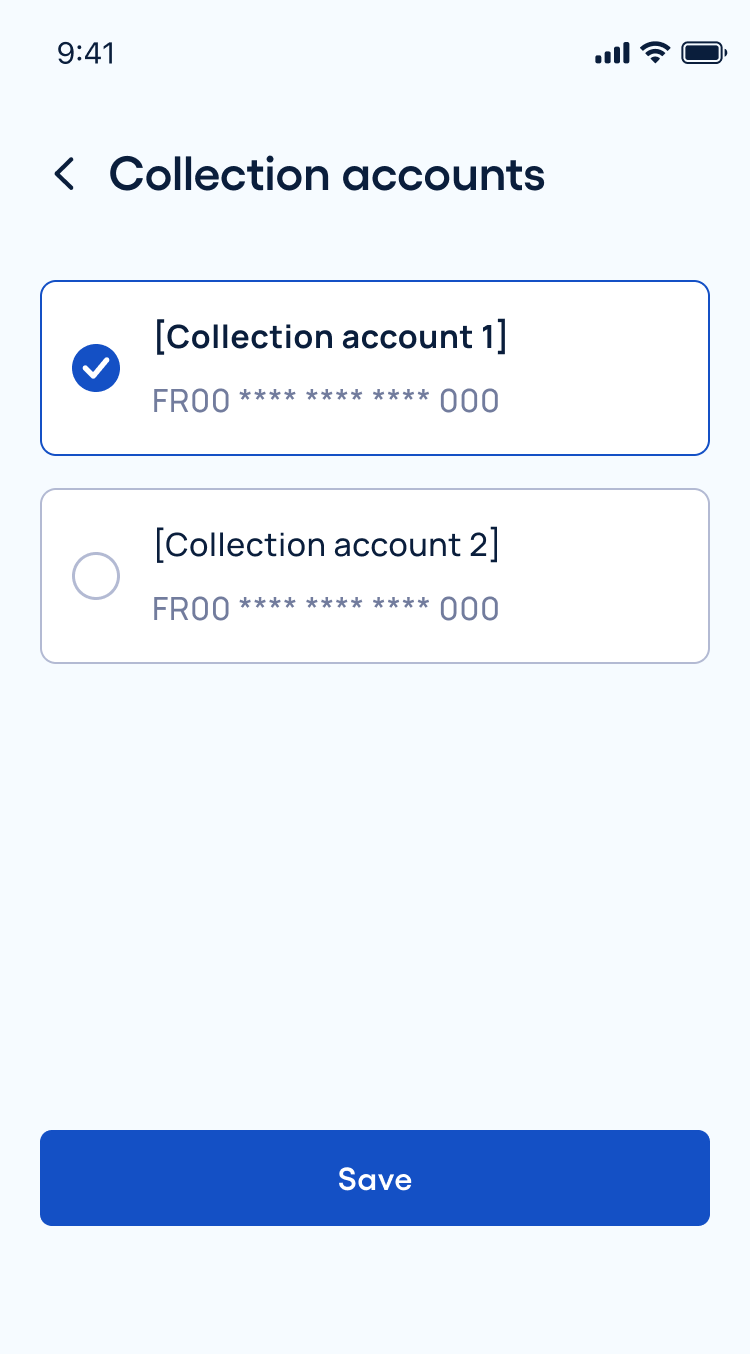

- On the Stancer app (iOS): Navigate to the Account section, tap on Collection Accounts, and select the account you want to display from the dropdown list.

|  |  |

|---|

Advantages of Using Multiple Accounts with Stancer

Distinct Tax Identification and Legal Entity: Each account can only be linked to a single legal entity and its tax identification number. If you manage multiple legally separate organizations, you must create a separate account for each.

Clearer Billing Information: Using the same Stancer account for multiple organizations may cause confusion.

Better Transaction Management: Separating transactions by activity makes it easier to track payments, generate reports, and reconcile bank transactions.

Bank Transfer Management: Each account can be linked to a different Bank Account for transfers, although you may use the same Bank Account for multiple Stancer accounts if needed.

5. Useful links

- FAQ

- Tap to Pay on iPhone & confidentiality

- « Tap to Pay on iPhone » Security

- How to use Tap to Pay on iPhone for your business

- Find the software version on your iPhone, iPad, or iPod

Terminal

Getting started with the terminal will only take you a few minutes. Follow the steps on this page to start receiving point-of-sale payments from your customers.

1. Order your terminal

Go to the “Terminal” page of your User Area and follow the steps. Once the order has been placed, you will receive a confirmation e-mail and you can follow the progress of your order on your User Area.

2. Receipt of your terminal

Stancer will send you a package containing:

- The payment terminal,

- Its charging base,

- Your merchant card: this is an encrypted magnetic card, which, if necessary, can be used to refund your customers. If you have not received any of these items, please contact our teams using the Help page on your User Area.

3. Activation of your terminal

You will need to activate your terminal as soon as you receive it. To do so, follow the steps described below:

- Connect the charging base of your terminal to the mains, then place the terminal on the base. The terminal will start to charge automatically.

- Power up your terminal. The terminal will connect to the 4G networks automatically using the SIM card, which has already been activated. Once connected, the terminal may occasionally install an update: no user action is required. Allow the terminal to update itself before making your first payment.

- Log in to your User Area: your terminal should now appear on the Terminals page.

- Congratulations, you can now accept a payment from your first customer!

4. Procedure for Returning a Payment Terminal (TPE)

The return procedure for a payment terminal (TPE) applies in the following cases:

Terminal exchange

Simple return (excluding contract termination)

For a TPE exchange:

In the case of an exchange, our logistics partner will deliver your new terminal in exchange for the old one.

To facilitate this process, please ensure the following steps are completed in advance:

Disconnect the TPE from any power source or network

Reset the terminal

Perform a manual batch collection

Pack the terminal in its original packaging with all accessories

If you are unavailable at the time of delivery, you can reschedule or change the delivery method directly on our logistics partner’s platform via the link provided in the tracking email.

⚠️ Note

If the old terminal is not ready to be collected at the time of delivery, you will be responsible for returning it at your own expense.

Simple return:

To return the terminal, please follow these steps:

Disconnect the terminal from any power source or network

Reset the terminal

Pack the terminal in its original packaging with all accessories

Send the package to the return address provided in your Client Area, under the “Terminal” section

Please keep the parcel tracking number, as our support team may request it to assist with the reception of your return.

For any questions or assistance with this procedure, our team is available at: support@stancer.com.

FAQ

- My terminal has no network connection: what should I do?

Sometimes connecting to telephone networks can be complicated: if the store is below ground, if the walls are very thick, or if there is poor coverage in the area, for example. You can then use the WiFi connection of your terminal (please consult the user manual that is provided). You will then benefit from the connection of your internet router or your telephone by means of shared connection/mobile access point options.

- I have lost or damaged my terminal: how can I get a new one?

Report the loss/theft/breakage of your terminal as soon as possible to our support number (indicated on the terminal base) in order to request a replacement.

- How can I add a new terminal to my fleet?

Log in to your User Area, then order a new terminal on the Terminal page.

- I have lost my merchant card: what should I do?

Order a new merchant card from the Terminal page of your User Area: click on the terminal concerned, then click on “Order a merchant card”. Please note that this carries a charge, in accordance with the Pricing & Fees.

- I can’t see the payment terminal in my User Area.

Updating your User Area may sometimes take a few minutes. If, after 24 hours, the payment terminal does not appear, please contact our teams using the Help page of your User Area.

- To which address should I return the Terminal?

Verifone c/o NSE Bâtiment B – Porte B/D ZA La Tour 03200 Abrest

Store

To launch your online activity, you can sign up for Stancer’s online Store service. We create, host and maintain an e-commerce website for you: the online Store.

The Store is based on PrestaShop’s technology and on the Stancer API. The API is already connected to your Store and enables you to accept payments from your customers as soon as it is created.

To launch your online Store, complete the following steps:

- Make sure your Stancer account is active.

- Send a store opening request to the following adress: onboarding@stancer.com.

- Once your request is approved, you will receive an email with your PrestaShop credentials.

- Your store is ready! You can add your products and start selling online easily with our integrated payment module.

Then, all you have to do is to send the address of your online Store to your customers. You will find this address on the online Store page of your User Area.