Payouts

This section is designed to provide you with information on the payouts of the amounts you collect using Stancer solutions.

General principles

To ensure the security of your business activity and those of your customers, we have set up a system for segregating the payments you receive. This means in practice that we hold back the payments you receive, for a period of seven days from the receipt of the funds. This period enables us to analyse these payments, in order to protect you against fraudulent transactions and/or transactions that finance illegal activities. During this stage, the payments you received are kept on your Stancer account: Stancer does not perform any operations on the amounts concerned. At the end of this seven-day period, the funds are automatically paid out to your Bank Account, minus our fees. These payouts are automatic: you do not need to take any action.

Point of attention

A payout can only be executed on a working day. This constraint sometimes leads to a delay in the execution of a payout, especially when the payout is possible during a weekend or a public holiday.

When using the payment terminal, it can sometimes take up to 48 hours for Stancer to receive the funds.

Track your payouts

Monitor the day-to-day progress of your customer payments using your User Area. Go to the Transfer page in your User Area to see a record of your past payouts and view scheduled future payouts. You can use this page to plan and manage your cash flow.

Payout status

The following table lists the different statuses of payouts within the User Area :

| Status | Description |

|---|---|

| Pending | Payout will be executed soon |

| In progress | Payout is being executed, funds will soon be on your Bank Account |

| Done | Payout was executed, funds are available on your Bank Account |

| Failed | Payout could not be executed, reach out to our support teams for more information |

Early payouts

Due to unforeseen circumstances, you may occasionally need access to your funds sooner.

We have therefore introduced early payouts, which allow you to receive your payments before the usual seven-day hold period has expired.

A fee applies to early payouts, as specified in our Pricing & Fees section (“Early Payout").

What is an Early Payout?

An early payout is a payout made to your Bank Account before the standard period of 7 business days defined in Stancer’s General Terms and Conditions.

In accordance with the applicable Pricing Conditions, each early payout is subject to a specific fee of 2% of the amount paid out.

Requesting an Early Payout

To request an early payout, please contact our support team at support@stancer.com, providing the following details:

Purpose and economic rationale: Indicate the reason for your early payout request and explain the financial interest it represents for your business.

Payout references: It is essential to include the references of the payouts concerned (format: pout_XXXX) in your request. You can find these references in the details of each payout in your User Area.

Once your request has been received, our team will carry out the necessary checks. You will receive a response within 48 business hours from the time we receive all required information.

FAQ

- The amount transferred to my Bank Account is less than the total transactions for my establishment: is this normal? We effect a transfer, the amount of which is equal to the total of your transactions, minus our fees. It is therefore completely normal for the amount that is actually wired to your IBAN to be lower than the total amount of the transactions for your business activity. You can find the exact amount of the fees applied by Stancer in your User Area, on the Transfers page.

After making transactions (payments, disputes, refunds), Stancer will return your money to you by bank transfer.

Cash Collateral

Cash collateral: a guarantee related to payment disputes

Cash Collateral is a legally provided financial guarantee (Articles 2374 et seq. of the French Civil Code), consisting of the temporary withholding of an amount for the benefit of the creditor, here Stancer, as security. It is intended, in particular, to cover potential Payment Disputes initiated by your Payers.

Why is it necessary?

A Payment, whether unauthorised by the Payer or incorrectly executed, may be disputed by the latter up to thirteen (13) months after its execution. In the event of such a dispute, Stancer is liable and must immediately reimburse the disputed amount. To anticipate this risk, the Cash Collateral is established upon your subscription to our Services.

A guarantee set out in the Agreement

Your contractual undertaking with Stancer includes the implementation of this guarantee, through the signature of the Cash Collateral Pledge Agreement, in addition to the General Conditions of Use. It takes the form of a pledge — in other words, a temporary retention of funds — to secure Stancer against the risks of disputes, in accordance with the applicable legal framework.

The Initial Collateral Amount is set at EUR 1.

This amount may evolve depending on your activity and risk profile.

A monthly adjustment mechanism

The amount of the Collateral is recalculated each month on the basis of four elements:

- Disputed Amounts over the last thirteen (13) months,

- Your monthly Collections,

- The monthly Average Collections over the last thirteen (13) months,

- Any other amounts owed to Stancer (e.g., fees for the provision of a terminal, unpaid invoices).

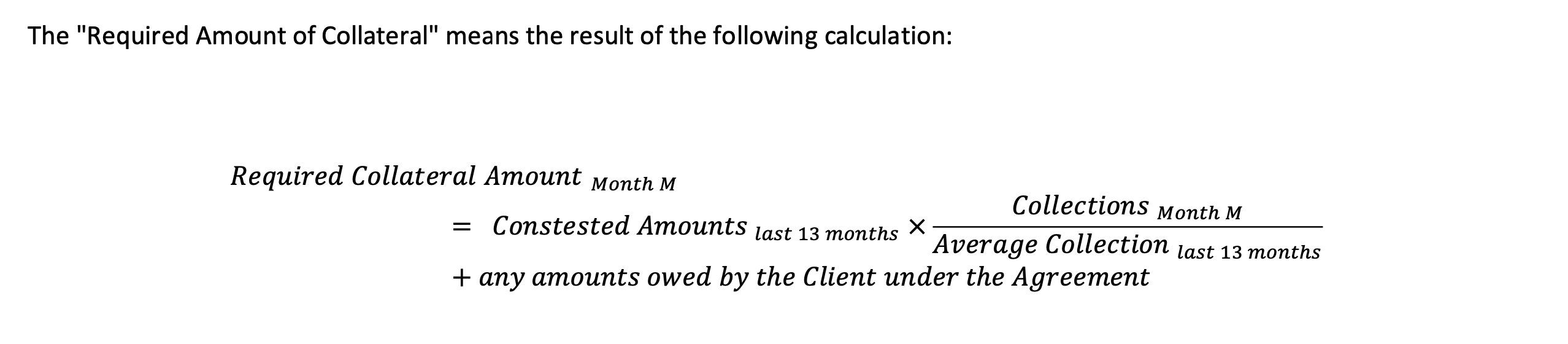

Simplified calculation formula:

Depending on the result:

If the Required Collateral Amount is higher than the existing Collateral, the Client authorises Stancer to debit their Payout Account at any time to align the Collateral with the Required Collateral Amount.

If the Required Collateral Amount is lower than the existing Collateral, Stancer shall credit the surplus back to the Payout Account.

In the event of insufficient funds on the Payout Account, the Client undertakes to credit their Bank Account, by any means and without delay, with the amounts necessary for this debit.

Monitoring and transparency

The amount of the Collateral varies according to your dispute rate. It is:

- Adjusted automatically, without any action required on your part

- Each adjustment is indicated in the details of the relevant Payouts in your User Area and via our API.

- Its amount is visible at any time on your invoices and under the My Account section of your User Area.

Repayment of the Cash Collateral

In the event of termination of the Agreement, the Collateral is retained on your Payout Account for a maximum of thirteen (13) months following the date of the last transaction, in order to cover any outstanding amounts due to Stancer. At the end of this period, Stancer shall return the Collateral to your Bank Account, less, where applicable, any outstanding amounts still owed to Stancer.

The detailed terms and conditions for repayment are set out in Appendix 3 of the General Conditions of Use.